Scalability

Automation

Customization

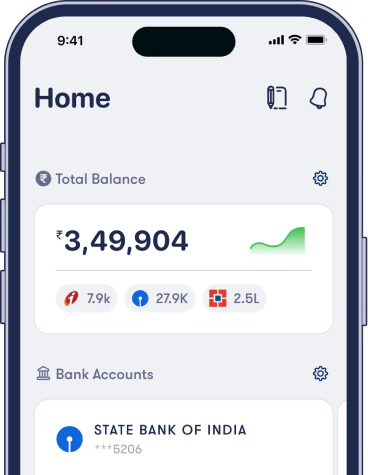

Analytics

Productivity

Security

Integration

USER FRIENDLY

Accounting Solutions for Growing

Enterprises project management solution.

Automated Invoicing

Expense Management

Financial Reporting

Inventory Tracking

COMPREHENSIVE

ERP Software for End-to-End

Business Management

Customised Solutions

Streamlined Processes

Real-time Insights

Regulatory Compliance

Supply Chain Integration

Scalability

THE ESARWA ADVANTAGE

THE ESARWA ADVANTAGEOptimise Efficiency and Automation

Streamlined Operations Time-saving

Solutions Error Reduction

Solutions Error Reduction

Cost-efficient Solutions

Resource Optimization Overhead

Reduction Compliance Assurance

Reduction Compliance Assurance

Better Management and Control

Real-time Visibility Effective Oversight

Control Assurance

Control Assurance

Achieve Scalability and Growth

Support for Expansion Adaptability to

Change Innovation Promotion

Change Innovation Promotion

Customer Satisfaction and Retention

Enhanced Service Personalised

Experiences Boost Satisfaction

Experiences Boost Satisfaction

Compliance & Risk Management Assurance

Regulatory Adherence Risk Mitigation

Data Security

Data Security

HOW IT WORKS

We Tailor Our Solutions to Adapt to Your Unique Needs

STEP 01

Request a free trial.

STEP 02

Experience our product with a 14-day trial period and a personalised demo.

STEP 03

Transition to full access with affordable payment options.

SMARTPRICINGfor every business

- • Budget-friendly tiers for all business sizes

- • Customised plans for your unique needs

- • Demos to experience your solutions before buying

CHOOSE

for solutions that guarantee operational

excellence, efficiency, and sustained growth.